Pros and Cons of Real Estate Investing: A Comprehensive Overview

Including actual property as an asset elegance on your making an investment portfolio provides range to lessen your normal funding risk. There are many actual property making an investment techniques to obtain this. Some options, like actual property funding trusts (REITs), are as passive as protecting dividend-paying stocks. Others, like shopping for and protecting condominium houses for coins go with the drift and capital appreciation, require lively involvement and a truthful quantity of expertise to be successful.

The Pros of Real Estate Investment

Real Estate Appreciates Over Time

Well-selected actual property appreciates over time, usually at a price that a ways outpaces annual inflation. Yes, there are occasional marketplace corrections, and those should buy the incorrect sort of belongings at the incorrect time. But I’ve observed there’s usually a hazard to shop for a great belongings at a discount, make enhancements to growth fairness and finally promote for a profit. It’s the actual property equal of the inventory marketplace mantra to “purchase low and promote high.”

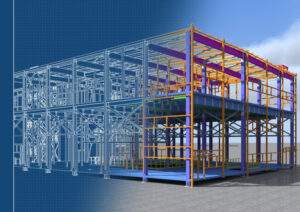

And actual property usually has an intrinsic fee. A inventory can cross right all the way down to zero, however a belongings is a tangible asset with the intention to usually have fee derived from each the uncooked land and the “enhancements” (the constructing systems connected to the ground).

Real Estate Has Unique Tax Benefits

Real property’s particular tax blessings permit buyers to develop their wealth over time. Rental earnings isn’t always concern to self-employment tax, and the authorities gives tax blessings to actual property buyers. These consist of depreciation and extensively decrease tax prices on long-time period profits. And relying for your earnings degree and class as an investor or Real Estate Companies in Abu Dhabi, there is a great hazard your condominium belongings will come up with an overage of tax deductions you could use in opposition to your different earnings. Rental actual property is a business, because of this that many fees, which includes tour prices to test for your houses, are tax-deductible fees of going for walks your business.

Real Estate Lets You Use Leverage

You can use the strength of leverage to quick develop your actual property holdings and boost up your wealth-constructing results. Leverage is the usage of borrowed capital to buy and/or growth the capacity go back on funding. Leverage, whilst used accurately to decrease risk, is a effective gain of actual property making an investment. Using a traditional loan, you could purchase an funding belongings with a 20% down price. So, for example, with preliminary funding of $30,000, you get the possibility to control — and get all of the blessings of owning — an asset worth $150,000. Done with right due diligence, you could construct your wealth exponentially the usage of leverage, particularly withinside the low interest-price marketplace we are presently enjoying.

The Cons of Real Estate Investment

Real property Investing additionally has a few dangers to keep in mind cautiously earlier than leaping in.

Real Estate Requires Money

You want cash to make cash. Forget the experts who promise, “You can get wealthy shopping for actual property with OPM (Other People’s Money).” While you could purchase stocks of inventory with a minimum coins outlay, actual property making an investment calls for cash. To get started, you may want a down price plus last prices and cash to restore and replace the belongings to maximise condominium earnings. And when you very own the belongings, there might be ongoing fees like belongings taxes, insurance, loan payments, and belongings maintenance.

Real Estate Takes a Lot of Time

You want to spend time mastering and handling your actual property investments. There’s a mastering curve, and you could lose quite a few cash in actual property in case you do not know what you are doing. On pinnacle of that, actively handling your condominium houses may be time-consuming.

However, a few offerings can do the “heavy lifting” on the subject of handling your condominium belongings. Roofstock is a web funding platform that helps you to buy turnkey condominium houses. That means, in case you choose, you do not should raise a finger. The service’s licensed belongings managers can do all the paintings for you. Plus, houses indexed on Roofstock are pre-vetted and already coins-go with the drift positive.

Real Estate Is a Long-time period Investment

Top Real Estate Companies In UAE ought to usually be offered with a longer-time period strategy. You’re shopping for a tangible asset which you cannot quick liquidate for coins in case you want emergency funds. It takes time to promote a belongings, and the transaction prices are better than promoting inventory stocks.

Real Estate Can Be Problematic

Tenants can purpose issues and fee you cash and precious time wasted in court. If you very own condominium houses, your coins go with the drift can take a sizable hit in case you grow to be renting to a tenant who would not pay, leaves the belongings in a very bad situation after they circulate out, or each.