How Tax Planning Tips Can Help Small Businesses Thrive

Table of Contents

- Maximize Deductions

- Leverage Tax Credits

- Implement Retirement Plans

- Maintain Accurate Records

- Consider Business Structure

- Plan for Healthcare Expenses

- Utilize Accountable Plans

- Consult Tax Professionals

Running a small business comes with unique challenges, and understanding how to effectively manage tax obligations can be the key to long-term success. Tax planning is more than just a once-a-year activity. Proactively implementing tax-saving strategies throughout the year can increase profitability, ensure compliance, and position your business for steady growth. Learning about efficient tax approaches empowers business owners to make smarter financial choices. Expert advisors, such as RMP Accounting, are invaluable partners in navigating the complex tax landscape and identifying key opportunities for savings.

Small businesses have many options to improve their tax situations by maximizing deductions, leveraging credits, and choosing the right legal framework. Staying organized and planning ahead helps minimize liabilities and avoid costly mistakes. Integrating these tax planning tips into daily operations cultivates stronger financial health and sets a foundation for a more resilient business model.

Maximize Deductions

Maximizing tax deductions is one of the most effective ways for small businesses to reduce taxable income. Deductions lower your overall tax bill, making it crucial to identify and claim every eligible business expense. Potential tax-deductible items include travel costs associated with business activities, a portion of home office expenses, marketing campaigns, professional service fees, new equipment purchases, and employee wages.

Maintaining excellent documentation is essential to ensure these deductions withstand scrutiny in the event of an audit. Maintain records such as receipts, invoices, and mileage logs to fully substantiate your claims. Proper record-keeping ensures you receive all the benefits you are entitled to and helps prevent penalties for underreporting or incorrect claims.

Leverage Tax Credits

Unlike deductions, which reduce taxable income, tax credits directly offset the amount of taxes owed and can create significant savings for small businesses. Important federal tax credits include the Work Opportunity Tax Credit (WOTC), which incentivizes the hiring of workers from groups that face employment barriers, and the Research and Development (R&D) Tax Credit, which rewards businesses investing in innovation and development.

There are many other tax credit programs at both the state and federal levels, and eligibility requirements do change over time. Staying informed about newly available credits allows businesses to continually improve their tax efficiency.

Implement Retirement Plans

Offering retirement plan options, such as SEP IRAs, SIMPLE IRAs, or 401(k) plans, provides substantial tax benefits for both employers and employees. Contributions to these plans are tax-deductible, thus reducing your business’s taxable income. At the same time, these plans can improve employee retention, boost morale, and help foster a stable, long-term workforce.

Establishing and contributing to retirement plans is also a great strategy for enhancing the personal retirement security of small business owners, thereby further strengthening the business’s financial future.

Maintain Accurate Records

Especially for small businesses, maintaining organized, up-to-date financial records is fundamental to successful tax planning. Accounting software makes this task more manageable, allowing owners to accurately track all income and expenses, categorize transactions by tax codes, and generate the necessary financial statements at tax time. Accurate record-keeping helps ensure that you do not miss out on deductions or credits, and provides valuable data to support better business decision-making throughout the year.

Consider Business Structure

The legal structure chosen for your business affects liability, tax obligations, and eligibility for specific tax benefits. Common business structures—including sole proprietorships, partnerships, LLCs, S corporations, and C corporations—each carry distinct advantages and drawbacks in terms of taxation. Reviewing your current structure and consulting with tax professionals to identify the most advantageous status can help you realize substantial savings while aligning with your business’s long-term goals.

Plan for Healthcare Expenses

Health benefits are increasingly important for both employees and business owners. Offering health insurance and establishing Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) can provide valuable tax advantages. Employer contributions to these plans are generally tax-deductible, and employees benefit from pre-tax contributions, which lowers overall taxable income. Implementing these healthcare options not only provides critical support to your team but also optimizes your total compensation strategy.

Utilize Accountable Plans

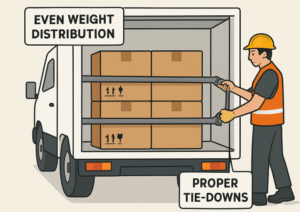

Reimbursing employees for business-related expenses through approved accountable plans offers strategic tax advantages. When structured properly and in accordance with IRS documentation requirements, such reimbursements are tax-deductible for the business and do not constitute taxable income for employees. Ensure that all plan policies are clear and that expense reimbursements are supported by proper receipts and a clear business purpose to qualify under IRS guidelines.

Consult Tax Professionals

Tax laws are complex and constantly evolving. Working with tax professionals who understand the intricacies of small-business taxation ensures your strategy aligns with current regulations and is tailored to your business’s specific needs. Tax advisors can help uncover savings opportunities and ensure compliance, saving both time and resources in the long run. Their expertise can prove invaluable at every stage of your business’s growth.

Final Thoughts

By taking a proactive approach to tax planning, small business owners can strengthen their company’s financial foundation, minimize liabilities, and unlock opportunities for sustainable growth. Thoughtful planning and the right support can make a measurable difference in your long-term success.